Online Banking

Use your time more productively and save yourself phone calls and trips to the credit union.

Apply for an Auto Loan without ever stepping foot in a branch.

From auto loans to refinancing a mortgage, WEOKIE has the resources and tools to create a lending program tailored to your needs.

At WEOKIE, our purpose is to build strong communities by supporting financial growth and well-being, one person at a time.

From E-statements to bill pay and mobile banking, our services make your life a little easier.

You'll love how easy it feels to manage your money on any desktop computer or smartphone. Choose the platform that's right for you!

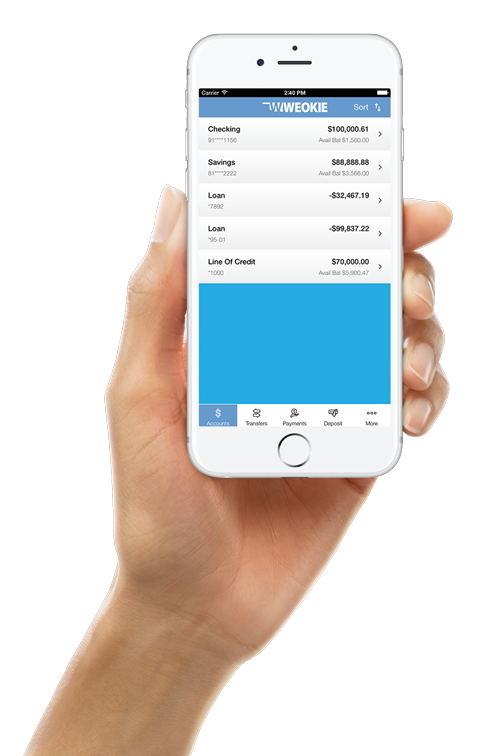

![]() Receive Instant Balances on Desktop or Mobile

Receive Instant Balances on Desktop or Mobile

Online Banking and Mobile Banking help you access your accounts online, 24 hours a day, seven days a week.

![]()

Pay Bills & Transfer Funds From Anywhere

Set your monthly expenses on autopilot and transfer your funds effortlessly from anywhere with an Internet connection.

![]()

Use Apple Pay, Google Pay, & Samsung Pay

With Mobile Payments, you can easily pay with your WEOKIE debit or credit card with just one tap or touch from your device.

Nov 15, 2024 by WEOKIE Federal Credit Union

After the turkey is gone and the Black Friday and Cyber Monday shopping frenzies have subsided, here comes Giving...

Nov 6, 2024 by WEOKIE Federal Credit Union

When we think of giving to charity, our minds often drift to the idea of clicking the “donate” button online. However,...

Nov 1, 2024 by WEOKIE Federal Credit Union

For even the strictest penny pincher, Black Friday usually offers sales that appear too good to resist. But our urge to...

Explore real examples of members we've helped save big to achieve financial freedom.

Chance came into WEOKIE to refinance his vehicle loan. He was paying 20% interest through the dealer.

WEOKIE was able to offer him our 1/2 off his first WEOKIE auto loan and lowered his interest rate to 3%. His monthly payments went from $419 a month to $274.

Over the life of the loan, Chance will save over $10,000.

Steven came in wanting to get a signature loan for several expenses. We noticed he had auto loan financed somewhere else.

We were able to refinance his auto loan and add the signature loan into it because he had equity in his auto.

We were able to lower his interest rate from 6.2% to 2.5% and since we added the signature loan, we saved him from getting a higher rate and two loans.

Steven ended up saving over $6,600.

We helped Kailey refinance her auto loan that she was paying 15.99%.

She was also able to lower her payments AND shorten the term of her loan.

WEOKIE was able to lower her interest rate to 3.99% saving her over $6,500 in interest.

Aileen & Todd came in to refinance their auto loan and were also hoping to pay off some credit card debt.

We were able to get them approved and used their auto as collateral and dropped their rate on the auto from 22% and the credit card interest rate at 21% down to one payment and a new rate of 2.99.

Over the life of bothloans they will save over $3,500.

Tina qualified for our 1/2 off her first auto loan at WEOKIE at a rate of 2.5% and refinanced her auto loan lowering her interest rate from 16.99%.

Tina saved over $6,800.

With WEOKIE, you can walk into any non-express branch location and sit down with one of our trusted advisors.

We’ll talk about your situation, identify opportunities to save you money and help you take that next step towards financial freedom.